SA-CCR Transactional Elements

The Standardized Approach for Counterparty Credit Risk (SA-CCR) is a regulatory framework developed by the Basel Committee on Banking Supervision (BCBS) for calculating the capital requirements for counterparty credit risk exposure in derivative transactions. This approach aims to capture the potential economic loss that a bank or financial institution could suffer in the event of a counterparty default. It takes into account the potential future exposure and the effect of netting and collateral.

The SA-CCR regulatory framework has the following elements:

Trades

Asset classes and hedging Sets

Netting sets

Collateral sets and collateral positions

Portfolios

Counterparties

ISDA® SA-CCR cross-platform support

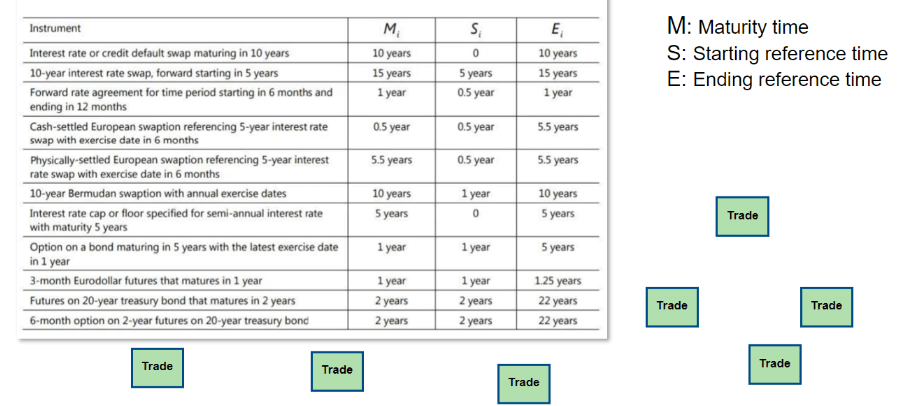

Trades

The basic element of the SA-CCR methodology is a trade. A trade is a single derivative transaction between two counterparties, used as a unit for calculating counterparty credit risk and capital requirements. A trade can involve different types of derivative contracts such as swaps, futures, and options which fall under different asset classes like interest rates, credit, equity, foreign exchange, and commodities. Under SA-CCR, each trade is individually evaluated based on its risk profile, underlying assets, and terms.

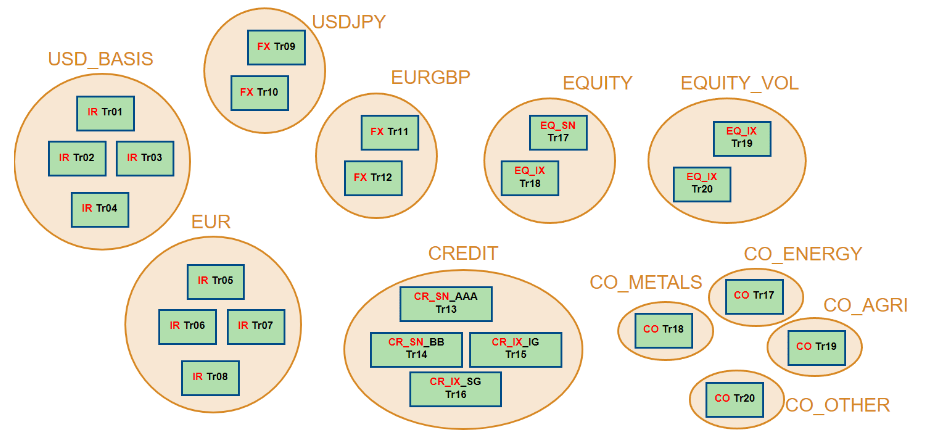

Asset Classes and Hedging Sets

Trades are organized by asset classes and hedging sets. In SA-CCR, asset classes refer to categories of financial instruments that exhibit similar characteristics and are subject to the same laws and regulations. The SA-CCR framework identifies these main asset classes:

Interest rate (IR) — This asset class includes any derivative contracts that derive their value from the performance of interest rates, such as interest rate swaps or options.

Credit (CR) — This asset class includes credit derivatives such as credit default swaps, total return swaps, and any other derivatives linked to credit performance.

Equity (EQ) — This asset class includes derivatives like equity options, futures, and swaps that derive their value from the performance of individual stocks or equity indices.

Foreign exchange (FX) — This asset class includes foreign exchange derivatives such as currency swaps, options, and futures.

Commodities (CO) — This asset class includes derivatives linked to the performance of commodities, such as commodity swaps, options, and futures.

In SA-CCR, a hedging set is a group of derivative transactions

that share the same risk factors and are typically hedged together. For example, a

hedging set might include all interest rate swaps that have the same currency because

these transactions would all be sensitive to changes in the same underlying interest

rates. The SA-CCR framework uses the concept of hedging sets to calculate the add-on for

potential future exposure (PFE). You can calculate the PFE add-on by using the addOn function. The PFE

add-on is calculated separately for each hedging set and then aggregated to give the

total PFE for a netting set.

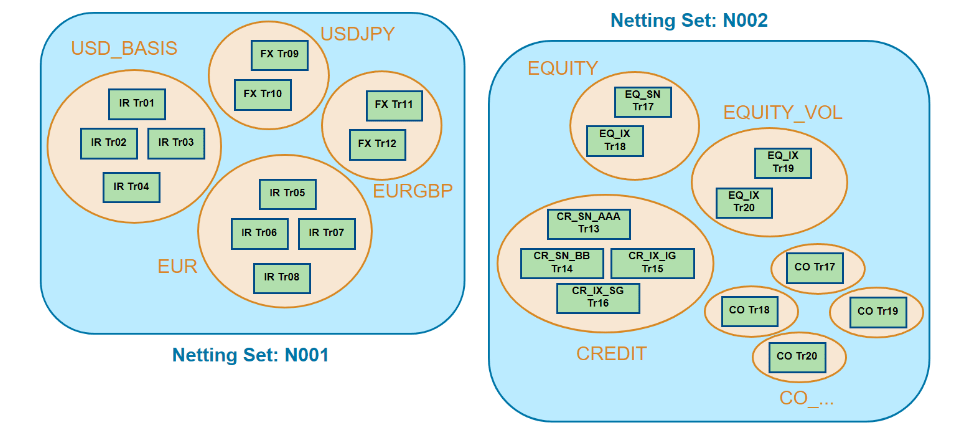

Netting Sets

In SA-CCR, a netting set is a group of derivative transactions

with a single counterparty that are subject to a legally enforceable netting agreement.

Netting agreements allow a bank or financial institution to offset positive and negative

exposures with the same counterparty, reducing the total counterparty credit risk. This

offset means that if one party defaults, the value of the positive and negative

transactions can be netted against each other, reducing the potential loss. In the

SA-CCR framework, you can calculate the exposure at default (EAD) by using ead function. The

potential future exposure (PFE) and the replacement cost (RC) of the derivative

contracts are calculated separately for each netting set and then are aggregated to

compute the EADs for each portfolio.

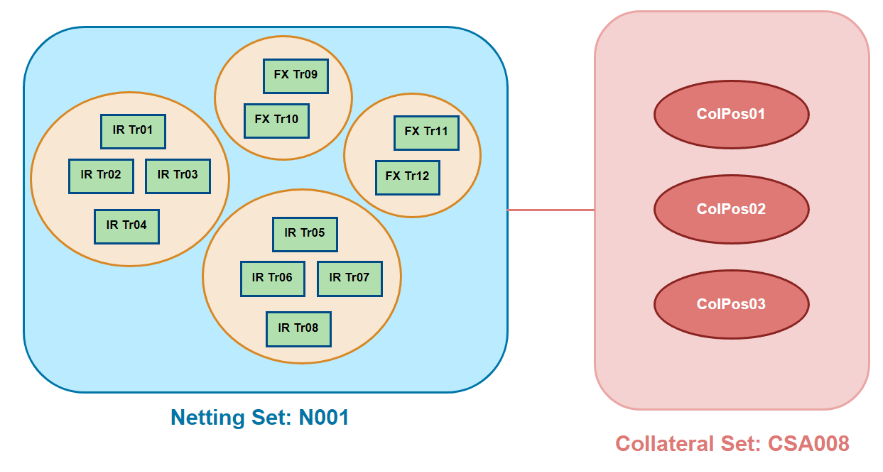

Collateral Sets and Collateral Positions

In SA-CCR, a collateral set refers to the collection of assets that have been pledged as security for a derivative contract or a group of contracts. The collateral set can include cash or other types of assets such as bonds, equities, or commodities, depending on the terms of the derivative contract and the collateral agreement between the two parties. In the SA-CCR framework, the value of the collateral set is taken into account when calculating the exposure at default (EAD), which measures the potential loss from a counterparty default. The collateral reduces the replacement cost (RC) and the potential future exposure (PFE), lowering the overall EAD.

In SA-CCR, a collateral position refers to the assets that have been pledged by a counterparty to secure a derivative contract. Collateral is used in derivative transactions to mitigate the risk of financial loss if the counterparty defaults on its obligations. It can include cash, securities, or other types of assets depending on the terms of the derivative contract. Under the SA-CCR framework, the collateral position is taken into account when calculating the exposure at default (EAD). The value of the collateral can offset the replacement cost (RC) and the potential future exposure (PFE), reducing the total counterparty credit risk exposure. The collateral position is subject to a haircut to account for potential changes in the value of the collateral assets over time. The haircut is determined based on factors such as the type of the collateral assets (CollateralHaircuts property).

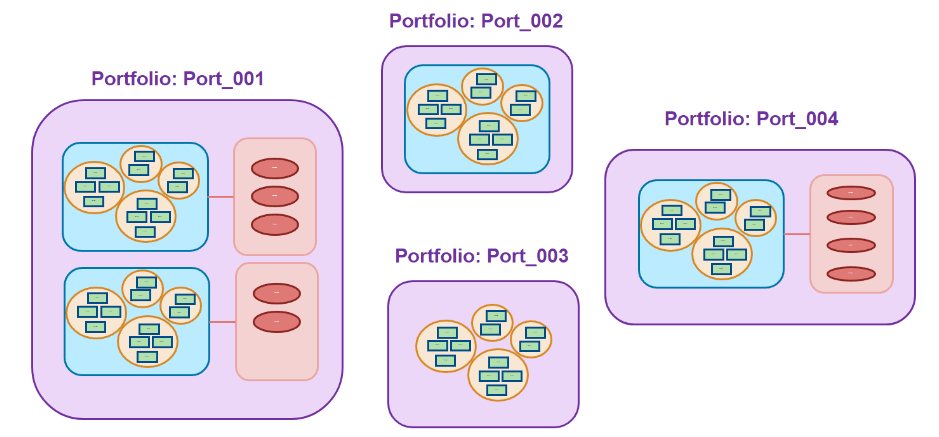

Portfolios

In SA-CCR, a portfolio refers to a collection of financial derivative trades that a bank or financial institution has with a particular counterparty. This portfolio can include a variety of derivative contracts such as swaps, futures, options, and so on, across different asset classes like interest rates, credit, equity, foreign exchange, and commodities.

The portfolio approach in SA-CCR allows for the netting of trades (offsetting positive and negative values) within each netting set, which can significantly reduce the overall counterparty credit risk exposure. The risk of the portfolio as a whole is considered when calculating the exposure at default (EAD), taking into account potential future exposures (PFE), replacement costs (RC), and the impact of collateral and netting agreements.

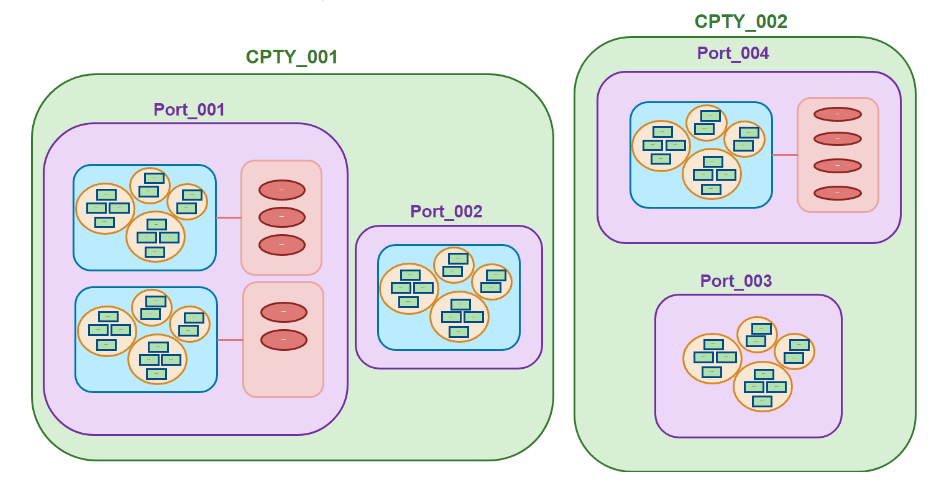

Counterparties

In SA-CCR, a counterparty is the other party involved in a financial contract or derivative transaction. In a derivative contract, the counterparty can be a bank, a financial institution, a corporation, or an individual with whom the bank has entered into the contract. Each party in the contract has obligations to fulfill, and the risk that one party will not fulfill its obligations is known as counterparty credit risk. The SA-CCR framework is designed to measure and manage this counterparty credit risk. It calculates the potential loss that a bank or financial institution could suffer if a counterparty defaults on its obligations under a derivative contract.

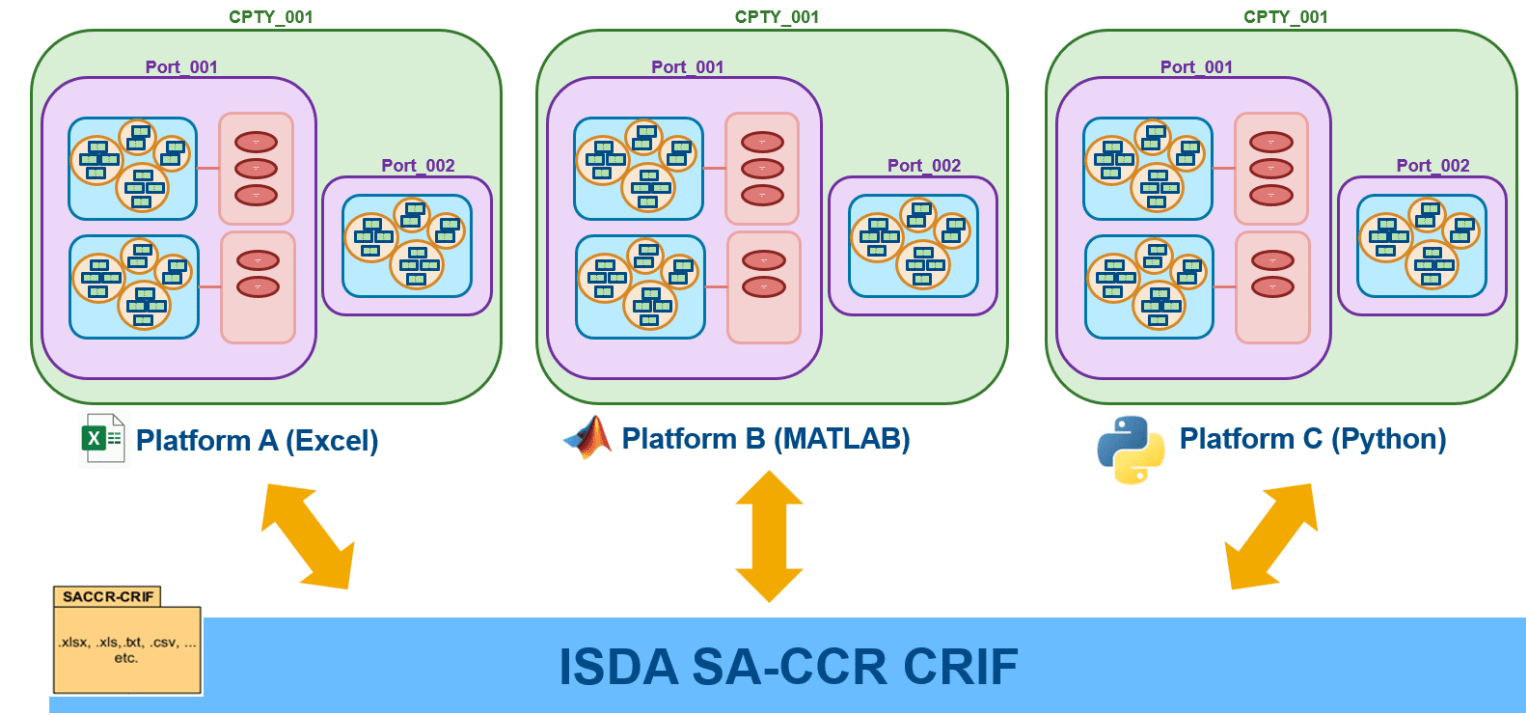

SA-CCR Cross-Platform Support

The ISDA SA-CCR CRIF file provides a cross-platform solution. The CRIF file format is system-agnostic, meaning you can use it across different software platforms and systems. For more information on the CRIF file format, see ISDA SA-CCR CRIF File Specifications.

The ISDA SA-CCR CRIF file provides a common language for representing and communicating the necessary data, making it easier for different systems to interpret and use this information consistently. The standardized format is particularly important for ISDA SA-CCR because the regulatory framework involves complex calculations that require a wide range of data inputs. The CRIF format helps to ensure that all necessary data is captured accurately and consistently, facilitating the implementation of the ISDA SA-CCR framework across different institutions and systems.

References

[1] Bank for International Settlements. "CRE52- Standardised Approach to Counterparty Credit Risk." January 2022. Available at: https://www.bis.org/basel_framework/chapter/CRE/52.htm.

See Also

saccr | rc | addOn | pfe | ead | addOnChart | eadChart | pfeChart | rcChart | frtbsa

Topics

- Framework for Standardized Approach to Calculating Counterparty Credit Risk: Introduction

- Create saccr Object and Compute Regulatory Values for Interest-Rate Swap

- Create saccr Object and Compute Regulatory Values for Forward FX Swap

- Create saccr Object and Compute Regulatory Values for Two CDS Trades

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set and Collateral Set

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set, Collateral Set, and Collateral Positions

- Create saccr Object and Compute Regulatory Values for Multiple Portfolios Containing Multiple Asset Classes

- saccr Object Structure

- ISDA SA-CCR CRIF File Specifications