saccr

Description

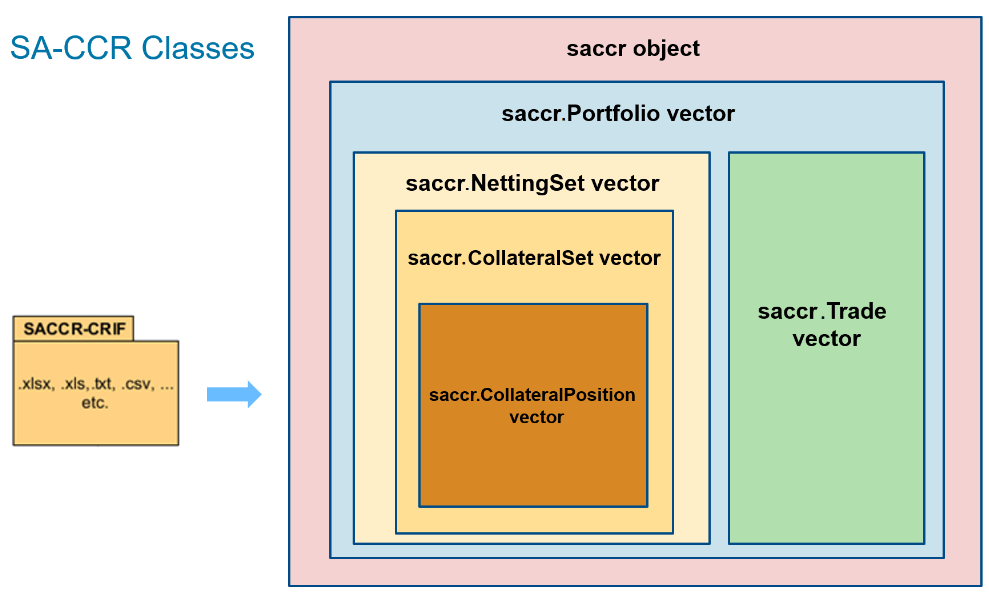

Create a saccr object using this workflow:

Create a SA-CCR CRIF file.

The ISDA® SA-CCR Common Risk Interchange Format (CRIF) is a standardized format developed by the International Swaps and Derivatives Association (ISDA) for reporting counterparty credit risk exposures under the Standardized Approach for Counterparty Credit Risk (SA-CCR) framework. For more information on creating an ISDA SA-CCR CRIF file, see ISDA SA-CCR CRIF File Specifications. SA-CCR functionality meets ISDA benchmarks for use in the

saccrobject.Create a

saccrobjectUse

saccrto create asaccrobject. The following objects are contained in thesaccrobject:Portfolio,NettingSet,CollateralSet,CollateralPosition, andTrade. For more information, see saccr Object Structure and SA-CCR Transactional Elements.Use

saccrobject functions.Use the following functions to calculate replacement cost (RC), add-ons, potential future exposure (PFE), and exposure at default (EAD):

Aggregate EADs.

After using

addOnandead, you can useaggregateto aggregate add-ons over all asset classes or EADs over all portfolios.After using

ead, you can use theaggregateByCounterpartyto aggregate EADs by counterparty.Generate charts to visualize the results using the following functions:

For more information on this workflow and a list of examples, see SA-CCR Transactional Elements and Framework for Standardized Approach to Calculating Counterparty Credit Risk: Introduction.

Creation

Description

mySACCR = saccr(SACCRCRIF)saccr object and sets the properties. The

saccr object provides an object-based framework that

supports Basel-compliant, International Swaps and Derivatives Association

(ISDA) workflows for calculating the capital banks must hold to

cover the risk that a derivative's trading partner will fail to pay its

obligation.

mySACCR = saccr(___,Name=Value)mySACCR =

saccr("SACCR_CRIF.xlsx",Alpha=1.3,DomesticCurrency="EUR",MaturityBusinessDaysFloor=7,NumBusinessDaysYear=255)

creates a saccr object. You can specify multiple

name-value arguments.

Input Arguments

Name-Value Arguments

Output Arguments

Properties

Object Functions

rc | Calculate complete replacement cost (RC) for each portfolio |

addOn | Calculate add-ons aggregated from all asset classes for each portfolio |

pfe | Calculate potential future exposure (PFE) for each portfolio |

ead | Calculate exposure at default (EAD) value for each portfolio |

addOnChart | Generate add-on chart |

eadChart | Generate exposure-at-default (EAD) chart |

pfeChart | Generate potential future exposure (PFE) chart |

rcChart | Generate replacement cost (RC) chart |

Examples

More About

References

[1] Bank for International Settlements. "CRE52 — Standardised Approach to Counterparty Credit Risk." June 2020. https://www.bis.org/basel_framework/chapter/CRE/52.htm.

[2] Bank for International Settlements. "CRE51 — Counterparty Credit Risk Overview." January 2022. https://www.bis.org/basel_framework/chapter/CRE/51.htm.

[3] Bank for International Settlements. "CRE22 — Standardised Approach: Credit Risk Migration." November 2020. https://www.bis.org/basel_framework/chapter/CRE/22.htm.

[4] Bank for International Settlements. "Basel Committee on Banking Supervision: The Standardised Approach for Measuring Counterparty Credit Risk Exposures." April 2014. https://www.bis.org/publ/bcbs279.pdf.

Version History

Introduced in R2024aSee Also

Functions

aggregate|aggregateByCounterparty|rc|addOn|pfe|ead|addOnChart|eadChart|pfeChart|rcChart|frtbsa

Topics

- Framework for Standardized Approach to Calculating Counterparty Credit Risk: Introduction

- Create saccr Object and Compute Regulatory Values for Interest-Rate Swap

- Create saccr Object and Compute Regulatory Values for Forward FX Swap

- Create saccr Object and Compute Regulatory Values for Two CDS Trades

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set and Collateral Set

- Create saccr Object and Compute Regulatory Values for Multiple Asset Classes with Netting Set, Collateral Set, and Collateral Positions

- Create saccr Object and Compute Regulatory Values for Multiple Portfolios Containing Multiple Asset Classes

- SA-CCR Transactional Elements

- ISDA SA-CCR CRIF File Specifications