optSensByBatesNI

Option price or sensitivities by Bates model using numerical integration

Syntax

Description

PriceSens = optSensByBatesNI(Rate,AssetPrice,Settle,Maturity,OptSpec,Strike,V0,ThetaV,Kappa,SigmaV,RhoSV,MeanJ,JumpVol,JumpFreq)

Note

Alternatively, you can use the Vanilla object to calculate

price or sensitivities for vanilla options. For more information, see Get Started with Workflows Using Object-Based Framework for Pricing Financial Instruments.

PriceSens = optSensByBatesNI(___,Name,Value)

Examples

optSensByBatesNI uses numerical integration to compute option sensitivities and then to plot option sensitivity surfaces.

Define Option Variables and Bates Model Parameters

AssetPrice = 80;

Rate = 0.03;

DividendYield = 0.02;

OptSpec = 'call';

V0 = 0.04;

ThetaV = 0.05;

Kappa = 1.0;

SigmaV = 0.2;

RhoSV = -0.7;

MeanJ = 0.02;

JumpVol = 0.08;

JumpFreq = 2;Compute the Option Sensitivity for a Single Strike

Settle = datetime(2017,6,29); Maturity = datemnth(Settle, 6); Strike = 80; Delta = optSensByBatesNI(Rate, AssetPrice, Settle, Maturity, OptSpec, Strike, ... V0, ThetaV, Kappa, SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, ... 'DividendYield', DividendYield, 'OutSpec', "delta")

Delta = 0.5630

Compute the Option Sensitivities for a Vector of Strikes

The Strike input can be a vector.

Settle = datetime(2017,6,29); Maturity = datemnth(Settle, 6); Strike = (76:2:84)'; Delta = optSensByBatesNI(Rate, AssetPrice, Settle, Maturity, OptSpec, Strike, ... V0, ThetaV, Kappa, SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, ... 'DividendYield', DividendYield, 'OutSpec', "delta")

Delta = 5×1

0.6807

0.6234

0.5630

0.5011

0.4392

Compute the Option Sensitivities for a Vector of Strikes and a Vector of Dates of the Same Lengths

Use the Strike input to specify the strikes. Also, the Maturity input can be a vector, but it must match the length of the Strike vector if the ExpandOutput name-value pair argument is not set to "true".

Settle = datetime(2017,6,29); Maturity = datemnth(Settle, [12 18 24 30 36]); % Five maturities Strike = [76 78 80 82 84]'; % Five strikes Delta = optSensByBatesNI(Rate, AssetPrice, Settle, Maturity, OptSpec, Strike, ... V0, ThetaV, Kappa, SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, ... 'DividendYield', DividendYield, 'OutSpec', "delta") % Five values in vector output

Delta = 5×1

0.6625

0.6232

0.5958

0.5748

0.5577

Expand the Output for a Surface

Set the ExpandOutput name-value pair argument to "true" to expand the output into a NStrikes-by-NMaturities matrix. In this case, it is a square matrix.

Delta = optSensByBatesNI(Rate, AssetPrice, Settle, Maturity, OptSpec, Strike, ... V0, ThetaV, Kappa, SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, ... 'DividendYield', DividendYield, 'OutSpec', "delta", ... 'ExpandOutput', true) % (5 x 5) matrix output

Delta = 5×5

0.6625 0.6556 0.6515 0.6483 0.6455

0.6222 0.6232 0.6239 0.6241 0.6238

0.5805 0.5900 0.5958 0.5996 0.6019

0.5381 0.5564 0.5674 0.5748 0.5798

0.4954 0.5225 0.5389 0.5499 0.5577

Compute the Option Sensitivities for a Vector of Strikes and a Vector of Dates of Different Lengths

When ExpandOutput is "true", NStrikes do not have to match NMaturities. That is, the output NStrikes -by- NMaturities matrix can be rectangular.

Settle = datetime(2017,6,29); Maturity = datemnth(Settle, 12*(0.5:0.5:3)'); % Six maturities Strike = (76:2:84)'; % Five strikes Delta = optSensByBatesNI(Rate, AssetPrice, Settle, Maturity, OptSpec, Strike, ... V0, ThetaV, Kappa, SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, ... 'DividendYield', DividendYield, 'OutSpec', "delta", ... 'ExpandOutput', true) % (5 x 6) matrix output

Delta = 5×6

0.6807 0.6625 0.6556 0.6515 0.6483 0.6455

0.6234 0.6222 0.6232 0.6239 0.6241 0.6238

0.5630 0.5805 0.5900 0.5958 0.5996 0.6019

0.5011 0.5381 0.5564 0.5674 0.5748 0.5798

0.4392 0.4954 0.5225 0.5389 0.5499 0.5577

Compute the Option Sensitivities for a Vector of Strikes and a Vector of Asset Prices

When ExpandOutput is "true", the output can also be a NStrikes-by-NAssetPrices rectangular matrix by accepting a vector of asset prices.

Settle = datetime(2017,6,29); Maturity = datemnth(Settle, 12); % Single maturity ManyAssetPrices = [70 75 80 85]; % Four asset prices Strike = (76:2:84)'; % Five strikes Delta = optSensByBatesNI(Rate, ManyAssetPrices, Settle, Maturity, OptSpec, Strike, ... V0, ThetaV, Kappa, SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, ... 'DividendYield', DividendYield, 'OutSpec', "delta", ... 'ExpandOutput', true) % (5 x 4) matrix output

Delta = 5×4

0.4350 0.5579 0.6625 0.7457

0.3881 0.5124 0.6222 0.7120

0.3432 0.4670 0.5805 0.6763

0.3010 0.4223 0.5381 0.6390

0.2619 0.3789 0.4954 0.6002

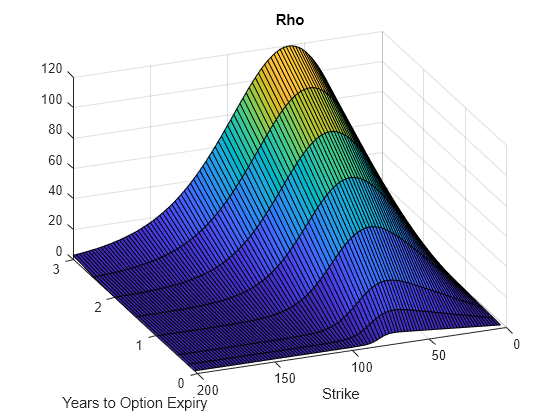

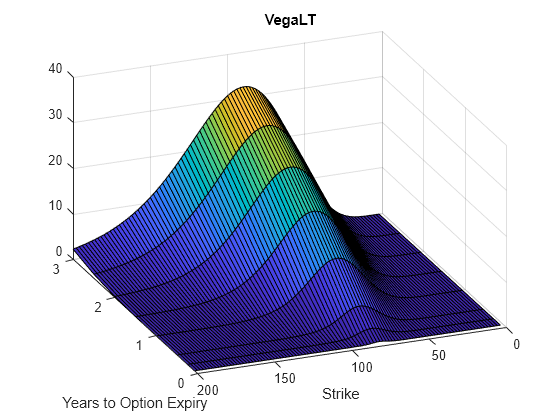

Plot Option Sensitivity Surfaces

The Strike and Maturity inputs can be vectors. Set ExpandOutput to "true" to output the surfaces as NStrikes-by-NMaturities matrices.

Settle = datetime(2017,6,29); Maturity = datemnth(Settle, 12*[1/12 0.25 (0.5:0.5:3)]'); Times = yearfrac(Settle, Maturity); Strike = (2:2:200)'; [Delta, Gamma, Rho, Theta, Vega, VegaLT] = optSensByBatesNI(... Rate, AssetPrice, Settle, Maturity, OptSpec, Strike, V0, ThetaV, Kappa, ... SigmaV, RhoSV, MeanJ, JumpVol, JumpFreq, 'DividendYield', DividendYield, ... 'OutSpec', ["delta", "gamma", "rho", "theta", "vega", "vegalt"], ... 'ExpandOutput', true); [X,Y] = meshgrid(Times,Strike); figure; surf(X,Y,Delta); title('Delta'); xlabel('Years to Option Expiry'); ylabel('Strike'); view(-112,34); xlim([0 Times(end)]);

figure; surf(X,Y,Gamma) title('Gamma') xlabel('Years to Option Expiry') ylabel('Strike') view(-112,34); xlim([0 Times(end)]);

figure; surf(X,Y,Rho) title('Rho') xlabel('Years to Option Expiry') ylabel('Strike') view(-112,34); xlim([0 Times(end)]);

figure; surf(X,Y,Theta) title('Theta') xlabel('Years to Option Expiry') ylabel('Strike') view(-112,34); xlim([0 Times(end)]);

figure; surf(X,Y,Vega) title('Vega') xlabel('Years to Option Expiry') ylabel('Strike') view(-112,34); xlim([0 Times(end)]);

figure; surf(X,Y,VegaLT) title('VegaLT') xlabel('Years to Option Expiry') ylabel('Strike') view(-112,34); xlim([0 Times(end)]);

Input Arguments

Continuously compounded risk-free interest rate, specified as a scalar decimal value.

Data Types: double

Current underlying asset price, specified as numeric value using a scalar or a

NINST-by-1 or

NColumns-by-1 vector.

For more information on the proper dimensions for AssetPrice,

see the name-value pair argument ExpandOutput.

Data Types: double

Option settlement date, specified as a

NINST-by-1 or

NColumns-by-1 vector using a datetime array,

string array, or date character vectors. The Settle date must be

before the Maturity date.

To support existing code, optSensByBatesNI also

accepts serial date numbers as inputs, but they are not recommended.

For more information on the proper dimensions for Settle, see

the name-value pair argument ExpandOutput.

Option maturity date, specified as a

NINST-by-1 or

NColumns-by-1 vector using a datetime array,

string array, or date character vectors.

To support existing code, optSensByBatesNI also

accepts serial date numbers as inputs, but they are not recommended.

For more information on the proper dimensions for Maturity, see

the name-value pair argument ExpandOutput.

Definition of the option, specified as a

NINST-by-1 or

NColumns-by-1 vector using a cell array of

character vectors or string arrays with values 'call' or

'put'.

For more information on the proper dimensions for OptSpec, see

the name-value pair argument ExpandOutput.

Data Types: cell | string

Option strike price value, specified as a

NINST-by-1,

NRows-by-1,

NRows-by-NColumns vector of strike

prices.

For more information on the proper dimensions for Strike, see

the name-value pair argument ExpandOutput.

Data Types: double

Initial variance of the underlying asset, specified as a scalar numeric value.

Data Types: double

Long-term variance of the underlying asset, specified as a scalar numeric value.

Data Types: double

Mean revision speed for the underlying asset, specified as a scalar numeric value.

Data Types: double

Volatility of the variance of the underlying asset, specified as a scalar numeric value.

Data Types: double

Correlation between the Wiener processes for the underlying asset and its variance, specified as a scalar numeric value.

Data Types: double

Mean of the random percentage jump size (J), specified as a

scalar decimal value where log(1+J) is normally

distributed with mean

(log(1+MeanJ)-0.5*JumpVol^2)

and the standard deviation JumpVol.

Data Types: double

Standard deviation of log(1+J) where

J is the random percentage jump size, specified as a scalar

decimal value.

Data Types: double

Annual frequency of Poisson jump process, specified as a scalar numeric value.

Data Types: double

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: PriceSens = optSensByBatesNI(Rate,AssetPrice,Settle,Maturity,

OptSpec,Strike,V0,ThetaV,Kappa,SigmaV,RhoSV,MeanJ,JumpVol,JumpFreq,'Basis',7)

Day-count of the instrument, specified as the comma-separated pair consisting of

'Basis' and a scalar using a supported value:

0 = actual/actual

1 = 30/360 (SIA)

2 = actual/360

3 = actual/365

4 = 30/360 (PSA)

5 = 30/360 (ISDA)

6 = 30/360 (European)

7 = actual/365 (Japanese)

8 = actual/actual (ICMA)

9 = actual/360 (ICMA)

10 = actual/365 (ICMA)

11 = 30/360E (ICMA)

12 = actual/365 (ISDA)

13 = BUS/252

For more information, see Basis.

Data Types: double

Continuously compounded underlying asset yield, specified as the comma-separated

pair consisting of 'DividendYield' and a scalar numeric

value.

Data Types: double

Volatility risk premium, specified as the comma-separated pair consisting of

'VolRiskPremium' and a scalar numeric value.

Data Types: double

Flag indicating Little Heston Trap formulation by Albrecher

et

al, specified as the comma-separated pair consisting of

'LittleTrap' and a logical:

true— Use the Albrecher et al formulation.false— Use the original Heston formation.

Data Types: logical

Define outputs, specified as the comma-separated pair consisting of

'OutSpec' and a NOUT-

by-1 or a 1-by-NOUT

string array or cell array of character vectors with supported values.

Note

"vega" is the sensitivity with respect the initial

volatility sqrt(V0). In contrast,

"vegalt" is the sensitivity with respect to the long-term

volatility sqrt(ThetaV).

Example: OutSpec =

["price","delta","gamma","vega","rho","theta","vegalt"]

Data Types: string | cell

Absolute error tolerance for numerical integration, specified as the

comma-separated pair consisting of 'AbsTol' and a scalar numeric

value.

Data Types: double

Relative error tolerance for numerical integration, specified as the

comma-separated pair consisting of 'RelTol' and a scalar numeric

value.

Data Types: double

Numerical integration range used to approximate the continuous integral over

[0 Inf], specified as the comma-separated pair consisting of

'IntegrationRange' and a 1-by-2

vector representing [LowerLimit UpperLimit].

Data Types: double

Framework for computing option prices and sensitivities using numerical

integration of models, specified as the comma-separated pair consisting of

'Framework' and a scalar string or character vector with the

following values:

"heston1993"or'heston1993'— Method used in Heston (1993)"lewis2001"or'lewis2001'— Method used in Lewis (2001)

Data Types: char | string

Flag to expand the outputs, specified as the comma-separated pair consisting of

'ExpandOutput' and a logical:

true— Iftrue, the outputs areNRows-by-NColumnsmatrices.NRowsis the number of strikes for each column and it is determined by theStrikeinput. For example,Strikecan be aNRows-by-1vector, or aNRows-by-NColumnsmatrix.NColumnsis determined by the sizes ofAssetPrice,Settle,Maturity, andOptSpec, which must all be either scalar orNColumns-by-1vectors.false— Iffalse, the outputs areNINST-by-1vectors. Also, the inputsStrike,AssetPrice,Settle,Maturity, andOptSpecmust all be either scalar orNINST-by-1vectors.

Data Types: logical

Output Arguments

Option prices or sensitivities, returned as a

NINST-by-1, or

NRows-by-NColumns, depending on

ExpandOutput. The name-value pair argument

OutSpec determines the types and order of the outputs.

More About

A vanilla option is a category of options that includes only the most standard components.

A vanilla option has an expiration date and straightforward strike price. American-style options and European-style options are both categorized as vanilla options.

The payoff for a vanilla option is as follows:

For a call:

For a put:

where:

St is the price of the underlying asset at time t.

K is the strike price.

For more information, see Vanilla Option.

The Bates model (Bates (1996)) is an extension of the Heston model, where, in addition to stochastic volatility, the jump diffusion parameters similar to Merton (1976) were also added to model sudden asset price movements.

The stochastic differential equation is:

where

r is the continuous risk-free rate.

q is the continuous dividend yield.

St is the asset price at time t.

vt is the asset price variance at time t.

J is the random percentage jump size conditional on the jump

occurring, where ln(1+J) is normally distributed with

mean and the standard deviation δ, and (1+J) has a lognormal distribution:

v0 is the initial variance of the asset price at t = 0 (v0> 0).

θ is the long-term variance level for (θ > 0).

κ is the mean reversion speed for (κ > 0).

σv is the volatility of variance for (σv > 0).

p is the correlation between the Wiener processes Wt and for (-1 ≤ p ≤ 1).

μJ is the mean of J for (μJ > -1).

δ is the standard deviation of

ln(1+J) for (δ ≥ 0).

is the annual frequency (intensity) of Poisson process Pt for ( ≥ 0).

The characteristic function for j = 1 (asset price mean measure) and j =2 (risk-neutral measure) is:

where

ϕ is the characteristic function variable.

ƛVolRisk is the volatility risk premium.

τ is the time to maturity for (τ = T - t).

i is the unit imaginary number for (i2= -1).

The definitions for Cj and Dj under “The Little Heston Trap” by Albrecher et al. (2007) are:

Numerical integration is used to evaluate the continuous integral for the inverse Fourier transform.

The numerical integration method under the Heston (1993) framework is based on the following expressions:

where

r is the continuous risk-free rate.

q is the continuous dividend yield.

St is the asset price at time t.

K is the strike.

τ is time to maturity (τ = T-t).

Call(K) is the call price at strike K.

Put(K) is the put price at strike K.

i is a unit imaginary number (i2= -1).

ϕ is the characteristic function variable.

fj(ϕ) is the characteristic function for Pj(j = 1,2).

P1 is the probability of St > K under the asset price measure for the model.

P2 is the probability of St > K under the risk-neutral measure for the model.

Where j = 1,2 so that f1(ϕ) and f2(ϕ) are the characteristic functions for probabilities P1 and P2, respectively.

This framework is chosen with the default value “Heston1993” for the

Framework name-value pair argument.

Numerical integration is used to evaluate the continuous integral for the inverse Fourier transform.

The numerical integration method under the Lewis (2001) framework is based on the following expressions:

where

r is the continuous risk-free rate.

q is the continuous dividend yield.

St is the asset price at time t.

K is the strike.

τ is time to maturity (τ = T-t).

Call(K) is the call price at strike K.

Put(K) is the put price at strike K.

i is a unit imaginary number (i2= -1).

ϕ is the characteristic function variable.

u is the characteristic function variable for integration, where .

f2(ϕ) is the characteristic function for P2.

P2 is the probability of St > K under the risk-neutral measure for the model.

This framework is chosen with the value “Lewis2001” for the

Framework name-value pair argument.

References

[1] Bates, D. S. “Jumps and Stochastic Volatility: Exchange Rate Processes Implicit in Deutsche Mark Options.” The Review of Financial Studies. Vol 9. No. 1. 1996.

[2] Heston, S. L. “A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options.” The Review of Financial Studies. Vol 6. No. 2. 1993.

[3] Lewis, A. L. “A Simple Option Formula for General Jump-Diffusion and Other Exponential Levy Processes.” Envision Financial Systems and OptionCity.net, 2001.

Version History

Introduced in R2018aAlthough optSensByBatesNI supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)